Ato Business Cash Flow Boost

Ato business cash flow boost ~ He has had an abn since then and pays wages to his chefs every week. Hi all our account told us we would be receiving the cash flow boost of 10 000 so when they did our bas 6130 the payment was credited to the ato bas account and we received a refund of 3870. The amounts will be equal to the total amount of initial cash flow boosts you received and will be split evenly over your lodgments.

Ato business cash flow boost Indeed recently is being hunted by users around us, maybe one of you. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this article I will talk about about Ato Business Cash Flow Boost.

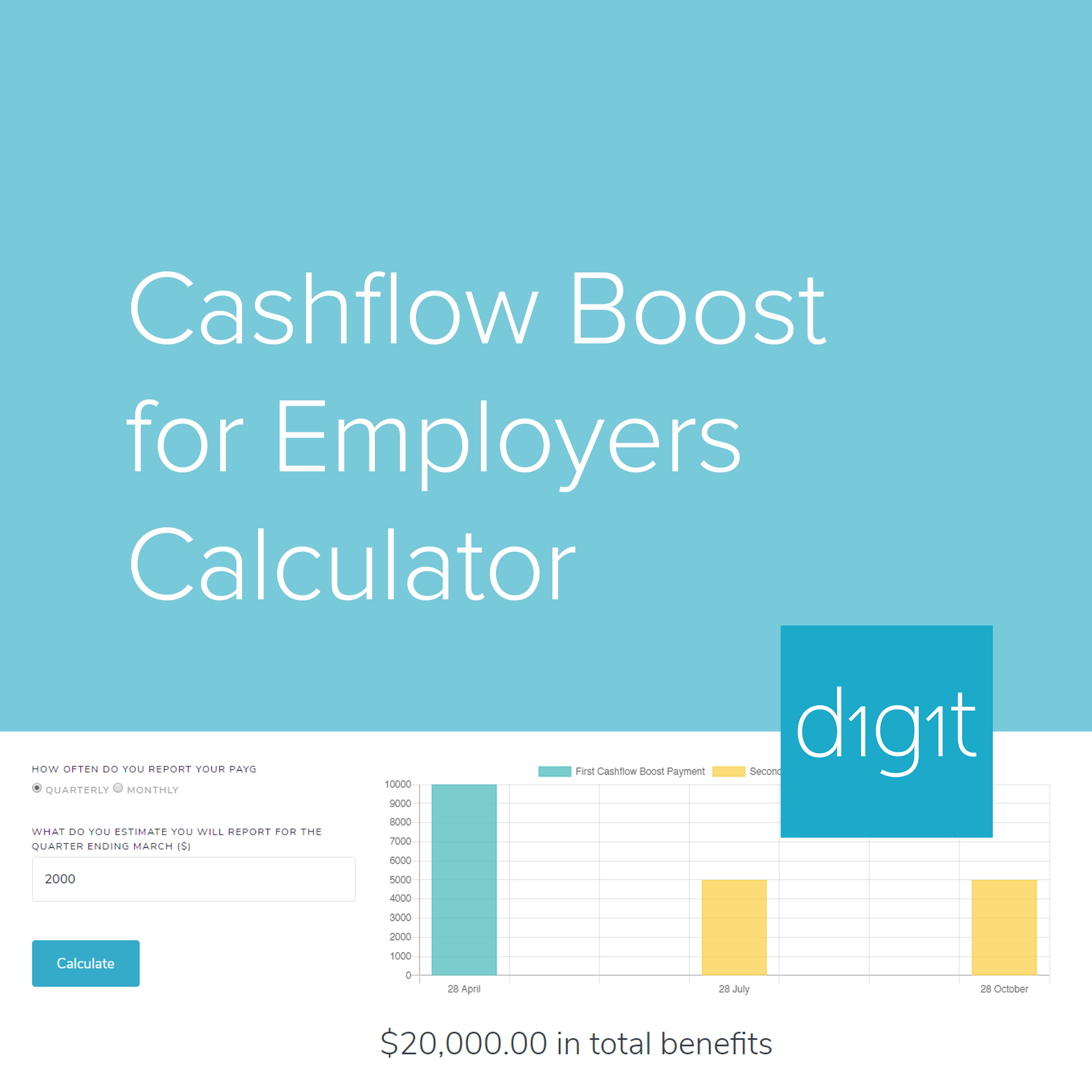

Quarterly you ll receive 50 of your total initial cash flow boost for each activity statement.

Ato business cash flow boost. However when times are tough there are some people who may try to use fraud to access or increase entitlements to the cash flow boost. We are committed to. June 2020 2 000 from the initial cash flow boost plus 7 000 from the additional cash flow boost. Monthly you ll receive 25 of your total initial cash flow boost for each activity statement.

Cash flow boost for employers fraudulent arrangements. Accessing the cash flow boosts. The cash flow boost is not a cash payment it s a credit on your activity statement. Supporting the australian community to access the help on offer.

Through the australian taxation office ato the government will provide tax free cash flow boosts of between 20 000 and 100 000 to eligible businesses delivered through credits in the activity statement system when they lodge their activity statements up to the month or quarter of september 2020. However he has lodged all his activity statements since july 2018. Working with people to get through this difficult time. September 2020 7 000 from the additional cash flow boost.

I m not sure how best to record this on myob essentials. We have received a credit from the ato to our account in the ato business portal for the original cash flow boost payment as part of covid 19 relief package for businesses. The amount received will be applied to the already lodged march ba. March 2020 12 000 from the initial cash flow boost.

Example 1 a business that is eligible for the cash flow boost. If your business is a large withholder for payg withholding purposes you should continue to pay your payg withholding to us as normal. Robert s 2019 tax return is not due until may 2020. Our accountant said the money that we would of paid the bas with was ours to use as we pleased and to u.

When she lodges her activity statements mary will receive cash flow boost credits of. Robert has operated a small restaurant in adelaide since 2015. The initial cash flow boost is based on the amount of your payg withholding a minimum of 10 000 and will be credited when you lodge your activity statements for each monthly or quarterly period from march to june 2020. To access the boosts you must lodge your activity statement for payg withholding.

If the posting of this site is beneficial to our suport by posting article posts of the site to social media marketing accounts you have such as for example Facebook, Instagram among others or can also bookmark this blog page together with the title Ato Warns Ecec And Other Employers That It Will Zero In On Fraud Use Ctrl + D for laptop devices with Glass windows operating-system or Control + D for personal computer devices with operating-system from Apple. If you use a smartphone, you can even utilize the drawer menu on the browser you use. Be it a Windows, Mac pc, iOs or Android operating system, you'll be able to download images utilizing the download button.