Are Business Meals Deductible 2019

Are business meals deductible 2019 ~ Wondering what you can still deduct on your 2019 taxes. Yet many feared the tax cuts and jobs act tcja eliminated this deduction starting january 1 2018. Top 25 tax deductions for small business.

Are business meals deductible 2019 Indeed recently is being sought by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of the post I will discuss about Are Business Meals Deductible 2019.

Roberta 2019 01 23t11 21 34 08 00 jan 23.

Are business meals deductible 2019. Business meals with clients. As discussed earlier you can deduct 50 of the cost of business meals. 2020 meals and entertainment deductions list. Ir 2020 39 february 24 2020.

To qualify the meal. Office snacks and meals. And meals and entertainment for business purposes are a legitimate business tax deduction but there are limits on what you can deduct. Small businesses can write off a number of expenses as tax deductions to help lower the amount they owe on their income tax.

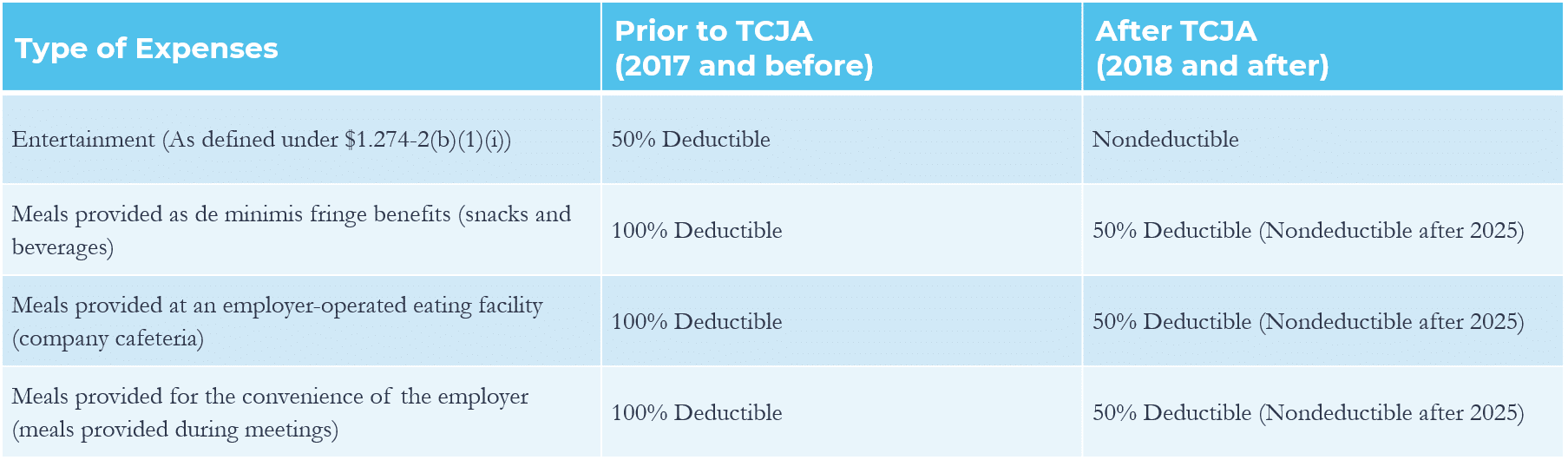

All of the following are expenses you can subtract from your year end tax bill either by 50 or 100 percent. The tcja eliminated business deductions for entertainment amusement or recreation irc sec. Washington the internal revenue service issued proposed regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act tcja. Because entertainment and meals are often closely intertwined when purchased in a business context taxpayers may have difficulty distinguishing deductible meal expenses from nondeductible entertainment expenses.

115 97 changed the rules for the deduction of business entertainment expenses. The 2017 tax cuts and jobs act has made major changes in the deduction of meals and entertainment expenses beginning with the 2018 tax year and going forward. For decades taxpayers could partly deduct the cost of business related meals. Business meals with clients 50 office snacks and other food items 50 the cost of meals while traveling for work 50.

Until the irs publishes its proposed regulations businesses may deduct 50 of business meal. Generally may continue to deduct 50 of the food and beverage expenses associated with operating their trade or business deductible requirements. The tax cuts and jobs act of 2017 tcja eliminated the deduction for entertainment purchased as a business expense but left intact the deduction for business meals. The top small business tax deductions include.

In general you can deduct only 50 of your business related meal expenses unless an exception applies. As a small business you can deduct 50 percent of food and drink purchases that qualify. See individuals subject to hours of service limits later. If you are subject to the department of transportation s hours of service limits you can deduct 80 of your business related meal expenses.

2019 new rules entertaining clients concert tickets golf games etc 50 deductible. The 2017 tcja eliminated the deduction for any expenses related to activities generally considered entertainment amusement or recreation. 2019 new meals and entertainment deduction requirements. 274 a this includes most things you d think of like entertainment and may fear that also.

For amounts incurred or paid after 2017 no business deduction is allowed for any item generally considered to be entertainment amusement or recreation.

If the publishing of this web site is beneficial to your suport by discussing article posts of this site to social media marketing accounts that you have got such as for example Facebook, Instagram and others or may also bookmark this website page using the title Tax Deduction Information Figure A Are My Points Fully Make use of Ctrl + D for computer devices with Windows operating-system or Command line + D for personal computer devices with operating-system from Apple. If you use a smartphone, you can also use the drawer menu in the browser you use. Be it a Windows, Macintosh personal computer, iOs or Google android operating system, you'll be in a position to download images utilizing the download button.